MEMORANDUM IN OPPOSITION

FOR IMMEDIATE RELEASE: February 27, 2019

RE: A.5248 (Gottfried)/S.3577 (Rivera)—AN ACT to amend the public health law and the state finance law, in relation to establishing the New York Health Act.

This legislation would create a government-run, single payer health plan. The New York Health Plan Association (HPA) opposes A.5248/S.3577.

HPA and our member health plans believe every New Yorker deserves coverage for high-quality, affordable health care, and the work of our member health plans in implementing the Affordable Care Act and the state’s Medicaid Redesign program is a major reason for New York’s ability in insuring more than 95% of state residents. The New York Health Act would undue that progress and the revisions to the bill do not address its fundamental flaws – it will result in massive new taxes and provide fewer choices over doctors, treatment and coverage, and threaten the quality of care for all New Yorkers.

Massive Tax Increases

Last year’s independent analysis by the RAND Corp. for the New York State Health Foundation estimated over $139 billion in new taxes would be needed in 2022 and $210 billion in 2031 to fund the New York Health Act, provided that the state received the necessary federal waivers and would be able to regulate provider rates and drug prices. The analysis noted that New York would need to increase taxes even further if the projected savings from cutting prices paid to providers don’t materialize or if wealthier New Yorkers and/or New York businesses abandon the state.

The analysis noted that the cuts in provider rates are highly uncertain and based on whether the state is willing and able to regulate the prices charged by doctors, hospitals and pharmaceutical manufacturers, despite any evidence of their willingness to be paid less than they are today. Additionally, the RAND analysis was predicated on the assumption that the state would receive a federal waiver, which is doubtful in light of CMS Administrator Seema Verma’s statements that CMS would likely deny waivers from states to launch single payment systems.

The revised bill fails to address these issues and skirts the essential question: How much will this cost New York residents and employers?

While proponents argue that a government-run, single payer system could address these costs and be financed from savings in administration and from bulk purchasing, any administrative savings associated with a single payer system will not be sufficient to ensure coverage for every New Yorker without a massive tax increase.

Further, Vermont, the only state that has voted for a government-run, single payer system, chose not to proceed once it determined that the financing would be impractical and require significant increases in corporate and income taxes that would be detrimental to individuals, employers and the state’s economy overall. In deciding to shelve its single-payer plan in 2014, former Vermont Governor Peter Shumlin stated that the costs of his proposed reform would be too great, noting:

“The taxes required to replace health care premiums with a publicly financed plan that would best serve Vermont are, in a word, enormous.”

Additionally, those who tout Medicare’s “low” administrative rates typically fail to note that some of Medicare’s capital and benefit costs are funded elsewhere in the federal budget, and that Medicare typically contracts with health plans to process claims and offer services that benefit consumers. Administrative costs, such as care management programs for individuals with chronic conditions, claims administration and health information technology, as well as government assessments, taxes and reporting requirements, account for roughly ten percent of the premium. A government-run system is unlikely to lead to significant long-term administrative savings.

Fewer Choices, Longer Wait Times & Diminished Quality

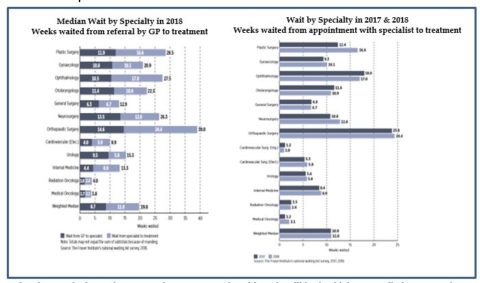

There are serious quality concerns associated with government-run, single payer systems. Even with massive tax increases, patients may still have to wait longer for treatment and won’t be guaranteed to see the doctor or specialist of their choice. Evidence demonstrates that these systems fail to provide timely access to high-quality, innovative medical care to all individuals. Often, patients have less access to the latest medical technology and breakthroughs, fewer choices and longer wait-times to receive basic and specialty care.

The Canadian system offers a good comparison to what is being proposed under the New York Health Act. A 2018 survey by the Fraser Institute, a non-partisan research and educational organization based in Canada, noted that waiting for treatment has become a defining characteristic of the Canadian health care system.[1]

- Its survey of specialist physicians reported a median wait time of 10.2 weeks from a referral by a general practitioner to consultation with a specialist.

- The survey also reported a median wait time of 19.8 weeks between referral from a general practitioner and receipt of treatment.

- Patients also experience significant wait times for various diagnostic technologies, including 10.6 weeks for a magnetic resonance imaging (MRI) scan, 4.3 weeks for a computed tomography (CT) scan, and 3.9 weeks for an ultrasound.

Rather than continuing to devote attention to a system that ultimately will lead to higher taxes, limit access and restrict options, the focus needs to be on efforts to expand coverage, address costs, and improve quality without disrupting current coverage options for employers and consumers.

For all these reasons, the New York HPA OPPOSES A.5248/ S.3577.

[1] Fraser Institute, Waiting Your Turn: Wait Times for Health Care in Canada, 2018 Report, published December 2018 https://www.fraserinstitute.org/sites/default/files/waiting-your-turn-2018.pdf